"PS9" (PS9)

"PS9" (PS9)

01/17/2014 at 15:39 • Filed to: catastrophes

6

6

27

27

"PS9" (PS9)

"PS9" (PS9)

01/17/2014 at 15:39 • Filed to: catastrophes |  6 6

|  27 27 |

Personal stuff inside, and it's a long read. Keep out if you bore easily.

In the Pre-Kinja days, before hardibird was piloting the U.S.S. Jalopnik, before the C7 was even a glint in GMs eye, everything for me was different. I had a vehicle. I had money in the bank. I was just finishing up my AA and had been accepted to a university.

Then came the great recession. Then came 2008. Everyone has their own perspective on how that event touched their lives. From mine... It was devastating. All the changes it brought to my life were negative, and I don't personally know any one who weathered it with their quality of life in tact. Livelyhoods were annihilated, and lives were lost. I watched someone go from being self made, doing everything right, having all their priorities in check and living the american dream, to being homeless and bankrupt, losing everything in the world that mattered to them at all. Here in 2014, I've still not recovered from that. No one in my circle on IRL friends can say they have.

So here's what I've learned about that time. This is the way I conduct myself now. The lessons taught to me by this economy even today were hard earned, and I am not interested in changing them.

NO. DEBT.

Loans, financing, credit products of any kind, all of it. No.

NO.

Not interested. Never will be interested. If I don't own it after one transaction, I don't want it. If I can afford it on credit, then I cannot afford it. "But you can improve your credit!" Nearly all the advantages to sparkling credit are financing related; another way of saying they are debt related. So, not interested.

The 4x Rule.

Want something? What does it cost? Lets say $100. Do I have $400? If not, I can't afford it. Things I need to survive are somewhat exempt. Things I can go without (A mirrorless camera, GT6, other things) are not.

Ownership.

"No loans, ehh? Guess you never plan on getting a nice car or becoming a homeowner, right?"

WRONG.

Ownership is how wealth is generated in this country, and it is central to my plans. If I can be in a position to save $10k/year, I can be a mere decade away for ownership. The

real

kind. The one where you don't lose your house and your car too if your industry gets packaged up and shipped elsewhere. The one where you don't have to helplessly watch while your APR on ARM almost doubles and balloons the payment beyond where it was budgeted to be acceptable (in the banks defense, my friend's divorce as well didn't help, but having them ask for hundreds more than what was agreed to in the middle of all that made

eeeeeverything

worse). The kind where you don't lose your transportation at the worst possible moment.

For me, ownership = real security, and given my experiences thus far, I am not interested in compromising on that even a bit. Without that leverage over my head, every single step forward, every passing year strengthens my position. Every $10k puts me further and further away from ever being subject to that level of insecurity and desperation, and I will not trade that in just to get something neat I want now. No.

My plans are not for everyone. They are actually only for just one; me. They are not a judgement against anyone. If loans and mortgages work for you, then go on ahead and get them. Enjoy them. You will not receive any negativity from me for making choices that work for you. But for me, here in post-2008 land? No. Even years from now, even if all my plans pan out and I have a six-figure bank account, I will still not ever do any kind of business involving loans and credit. Never.

V8Demon - Prefers Autos for drag racing. Fite me!

> PS9

V8Demon - Prefers Autos for drag racing. Fite me!

> PS9

01/17/2014 at 15:46 |

|

Difficult to procure home ownership under this model. Although, admittedly if I were 15 years younger and single, a home wouldn't be on my list to be honest. A one bedroom condo perhaps, but home ownership isn't what it used to be nor is it the staple of the American dream anymore.

Pick pretty much any link in this google search for more reading: https://www.google.com/search?q=time+…

Perusing one of the articles shows a statistic in which around 40% of people U.S. under the age of 35 (I'm assuming the demographic is 18-35) own their own home. I bought mine @ 28......Guess things weren't so bad in 2004.....

Battery Tender Unnecessary

> PS9

Battery Tender Unnecessary

> PS9

01/17/2014 at 15:48 |

|

I finance cars, but only if I have a good chunk of it already set aside and even then I lock it away in a savings account. That way if an emergency arose that I needed the money I would have spent buying the car outright, I wouldn't be scrambling to sell the car at a loss because I need money quick. I've never needed a large chunk suddenly but you never know. I try and stay as liquid as possible. There's such thing as responsible use of credit, it's just that most people don't practice it.

Decay buys too many beaters

> PS9

Decay buys too many beaters

> PS9

01/17/2014 at 15:50 |

|

This is how my parents raised me to be (well minus the 4X rule) and it's probably the reason I'm not swimming in debt right now.

TheBaron2112

> PS9

TheBaron2112

> PS9

01/17/2014 at 15:52 |

|

When I bought my car I discovered my credit score was in the 800s. As such, I got 0% interest on my car payments. What people don't get is that you don't need debt to do that.

1. Get a credit card. Use it like a debit card. if you don't have money (your 4x rule), don't buy the thing you want.

2. Rent. Pay rent. Pay on time.

3. Pay everything on time. Always.

KusabiSensei - Captain of the Toronto Maple Leafs

> PS9

KusabiSensei - Captain of the Toronto Maple Leafs

> PS9

01/17/2014 at 15:56 |

|

May I also mention that you never actually outright own your property? I assume you have heard of property tax?

The government can still seize your land or personal property for non-payment of tax.

McMike

> PS9

McMike

> PS9

01/17/2014 at 16:00 |

|

Hi, I'm 44 and I learned the same lessons from living paycheck to paycheck in the early 90s. I was riding a bicycle to work when I was 21.

It was my own recession that taught me to be responsible.

Good for you.

PS9

> V8Demon - Prefers Autos for drag racing. Fite me!

PS9

> V8Demon - Prefers Autos for drag racing. Fite me!

01/17/2014 at 16:03 |

|

A lot of that was/is due first to tightening of credit markets in the fresh post-crash environment, and now, to increases in mortgage rates, stricter lending terms, and a segment of the population - like me - who have yet to fully recover from the crash, coupled with rising overall real estate prices and a market flush with investors who purchased homes for rental property purposes.

In my model, I'm the lender. I'm not going to decline myself. Prices are rising, but even when they were at insanely inflated pre-crash levels, there was always a home in the price range I wanted to buy it in. The American Dream may not be about homeownership anymore, but the security involved in 100% owning a place to live for me is and always will be. I don't care how hard it is to do because all the directions require difficulty. If I have to squeeze blood from a stone, I will only do it for something I truly want.

boobytrapsandtreasure

> PS9

boobytrapsandtreasure

> PS9

01/17/2014 at 16:09 |

|

Bravo! Make it work! It sounds like a solid plan to me.

One more thing you may want to think about is not owning anything that owns you. By that I mean keeping your expenses down by not owning things that cost excessive amounts of money to maintain.

Mike_Smith

> PS9

Mike_Smith

> PS9

01/17/2014 at 16:17 |

|

I'm not sure why any of this is new information to be discovered by millenials. This is old wisdom, and used to be the way everybody did things until we suddenly went debt-crazy in the years bracketing the turn of the century. It's very simple - don't spend or borrow what you can't afford. The trick is being realistic about what you can afford.

But I think you're a bit over-averse to debt, and especially leasing. A wise man once taught his Econ class (which I was in) to lease things that depreciate (like cars), and buy things that appreciate (like homes - even with 2008, real estate appreciates over the long term). And if the appreciation in the asset outstrips the interest on the loan, it makes sense to borrow - again, within your means. For home loans, I would add - stay away from ARMs, and stay away from anything over 30 years. You can always refinance if the terms improve. I did, and turned a 30-year loan at 5.6% into a 20-year loan at 3.8% and still knocked $500 a month off my payment.

Stupidru

> PS9

Stupidru

> PS9

01/17/2014 at 16:27 |

|

I'm just curious. Why is the 4x rule in place? Why not 2x? What if you want a cheeseburger? That Dollar-Menu Cheeseburger doesn't take $3 to maintain it, nor does a television. Car and motorcycle ownership, I have learned costs $0.50-$0.60 per mile, all costs included no matter how long you plan on owning it. If you buy a $500 beater, it won't run forever for $2,000.

So enlighten me- I'm just wondering why it's 4x

PS9

> Stupidru

PS9

> Stupidru

01/17/2014 at 16:40 |

|

If you must spend a large amount of money right now, to the point of it being a great chunk of all you have, which is better to spend? 1/2? Or 1/4? Which one leaves you less exposed in case of disaster? Are you better off with more cash on hand? Or less?

It would be a 10x rule if I could do it, but circumstances make that impractical for now, so 4x it is.

punksmurph

> boobytrapsandtreasure

punksmurph

> boobytrapsandtreasure

01/17/2014 at 16:40 |

|

Very true, there are many cars I would never consider because of this.

alexotics

> boobytrapsandtreasure

alexotics

> boobytrapsandtreasure

01/17/2014 at 16:49 |

|

Except for cars. It's ok to own cars that are expensive to fix/operate.

/becauseJalopnik

B_dol

> PS9

B_dol

> PS9

01/17/2014 at 16:51 |

|

I'm a millennial. This view point seems a bit extreme. I took out loans to go to a better college than I could afford otherwise, and that investment has paid for itself and then some.

This whole no debt thing is blown out of proportion. Investing pays off...

PS9

> Mike_Smith

PS9

> Mike_Smith

01/17/2014 at 17:57 |

|

I'm not sure why any of this is new information to be discovered by millenials.

It is not new information to you. Humans do not pass down information genetically. If you are not told, you will not know. If those who know spend one generation not passing the information down, it will be forgotten. We did in fact do just that, and it transformed our economy into one where profit from debt was possible, and concentrated ownership of assets into the hands of a few large organizations.

All that's well and good. If you want to play a role in that, and find success in that, good for you. Hope everything works out there for you. Will not be joining you in that under any circumstance.

But I think you're a bit over-averse to debt, and especially leasing.

It's considerably more than a tiny bit. Ownership is the ultimate upside. If the transaction does not result in ownership for me, it is not happening. Simple as that.

For home loans, I would add - stay away from ARMs, and stay away from anything over 30 years.

Better yet, I'll stay away from all of it. Make a tiny sacrifice in the short term, and pocket all the money that would have gone to interest in the future. Get ownership ASAP instead of waiting 30 years, or 15 years, or however long for it. Be protected in case of economic calamity instead of exposed. I'll sacrifice something now for a better future instead of sacrificing tomorrow to live slightly better today.

J. Drew Silvers

> PS9

J. Drew Silvers

> PS9

01/17/2014 at 18:17 |

|

Let me first say that I'm not hating on you at all, but this isn't anything monumental. It's just opposition to the machine. Fifty years ago, the majority of people used the same model you have presented here, only it wasn't a model - it was just how you did things. My paternal grandparents, two uncles, and my own parents have never had a mortgage on their homes. They saved or went without. They weren't wealthy either: factory machinists, farmers (small time survival), and my dad worked hourly in a warehouse until I was a teenager. Back then it was possible, now? It still IS possible, but not quite as likely.

Or you end up like me who had a high-paying, "secure" career, lived within my means, did everything right financially and in my job, but was still thrown into unemployment. I lost my cushion, savings, earnings, and have been rebuilding and starting over for two years, now 27 years old.

This led me to start a blog which I wont promote on your post, but a link is in my profile, which consists in its majority of how we just need to go back in mindset about fifty years with most of our life ideas. That's it.

PS9

> KusabiSensei - Captain of the Toronto Maple Leafs

PS9

> KusabiSensei - Captain of the Toronto Maple Leafs

01/17/2014 at 18:21 |

|

You do outright own your property. Taxes levied against an asset is not the same thing as government ownership of an asset. Ownership of assets - even very great ones, like thousands of home properties or a major corporation - do not transform one into a sovereign entity. If you use the resources provided to you by the government to find success and prosperity - and you did, since it is not possible without currency, infrastructure, security from enemies within the border as well as without, and a successful and educated populous you can turn into patronizing customers - you must give back. The more you succeed, the greater your use, so the more you have to give back.

If I purchase a home for $100k at 100% ownership, the government will levy taxes against my assets, and I am totally fine with that. I cannot amass $100k in savings without considerable use and impact on local and national resources to do it, so I will be expected to give back. I'm a responsible adult, so I have no issue with this.

Government ownership of the property would make property seizure cases - at least when it comes to homes and land - non-existent, since you don't have to go to court and petition for the seizure of stuff you already own. It would also empower the government to act as a mortgage agency, and leverage the full value of the property against the occupants. If I fail to pay the small fraction they tax me for, then I deserve to have my property seized from me, just like all the other tax evaders do. I'd be no different.

KusabiSensei - Captain of the Toronto Maple Leafs

> PS9

KusabiSensei - Captain of the Toronto Maple Leafs

> PS9

01/17/2014 at 20:40 |

|

Take the scenario where you do not buy, but instead inherit a piece of property. The problem with property taxes is that they are assessed against non-generated assets within a specific calendar year. i.e. it is possible to own an asset that you are not able to provide a payment against a tax levy for.

If said property comes into your possession through no fault of your own, your choices are to either liquidate the asset, or deal with a tax lien being placed on the property by the taxing authority.

Therefore the property tax becomes regressive for anyone who's income/asset ratio approaches 0. Normally this is gotten around by value exemptions in the assessment process. The mere fact that this has to be done to protect the ownership of property of low income/high asset ratio individuals tells me that the property tax is a non-ideal way to fund local governments.

I would prefer to see abolition of property taxes, and a combination of either income taxes or VAT levies replace the revenue.

George McNally

> PS9

George McNally

> PS9

01/17/2014 at 21:48 |

|

Smart move. My wife and I are in our mid fifties and with the exception of a mortgage-we've followed this philosophy for the past 30 years.

Result?

Right now I drive a 14 year old Saturn but we have enough money put away to retire in the very near future.

Keep doing what you're doing- it *will* pay off.

Lets Just Drive

> PS9

Lets Just Drive

> PS9

01/17/2014 at 23:41 |

|

Credit isn't a bad thing.

I'm just saying.

Or maybe it's a necessary evil but regardless the golden-age idealism of "ownership or nothing" isn't practical in today's economy. Literally every single one of my peers has been forced to use credit at one time or another if they weren't the recipients of sudden fiscal good fortune (inheritance, "old money" etc). It's all well and good to talk about how you're not going to own it until you can outright afford it, but the reality is that there is a world of difference between what a person can afford and what a person can afford to buy outright. A person can afford to make monthly payments on a $450,000.00 house though very few people can afford to spend that out of pocket. This is the reality of large purchases in the modern economy and sadly there isn't a strong infrastructure in place to support the classic ideology that old America seemed to love in the turd-shined 50's - the credit system is set up to simultaneously assist and take advantage of the individual. Stepping outside of that system is difficult without the benefit of a well padded bank book.

samssun

> PS9

samssun

> PS9

01/18/2014 at 08:35 |

|

"If you use the resources provided to you by the government to find success" And there's the rub. That people have been trained to think of government as an omnipotent being that owns all, provides all, and anything you do without it is just you "finding" success, with its permission. Some of us still know that before a politician can hand out anything to buy another vote, it must first be created by someone else. People earned before government allowed them to...government can't provide until someone earns.

Casper

> PS9

Casper

> PS9

01/21/2014 at 11:42 |

|

How exactly is home ownership central to wealth? The math doesn't work on that one. Speaking as a home owner, you are never really safe. First, without a loan of any kind you are subject to the whims of bureaucrats at all levels of government in the form of taxes, zoning, right of ways, and permitting. Second, houses cost a significant amount per 5 years to keep and are on an accelerating cost curve. The curve becomes more extreme if you must meet certain requirements placed on you by the city or HOA.

Loans are not a bad thing. If you do not ever process through a lending system you will not have credit to do and leveraging. Without leveraging you will never be able to flex outside your direct wealth pool. Likewise, you will also lack access to emergency funds. Just because you own a house doesn't mean you won't have some major problem where the HVAC, water heater, oven, and fridge all go out at the same time due to bad luck... the same week your car blows it's engine.

Loans aren't bad. Stupid people are bad. Credit lines are like rope. Give it to people who know how to use it, and they can climb Everest. Give it to stupid people and they will hang themselves with it.

PS9

> Casper

PS9

> Casper

01/21/2014 at 13:18 |

|

How exactly is home ownership central to wealth?

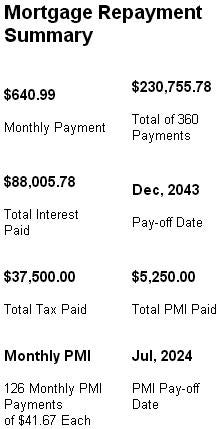

On a 30 year, $100k Mortgage @ 5% APR, the buyer will pay $230k by the end of the mortgage. $88k of that is interest for the lending entity.

If you could mortgage all the property in the united states - which is worth about $25 trillion - for an average of 5% APR, you could stand to make a $22T profit across 30 years, and your assets would effectively swell to $47T. Congratulations; you have just learned how the modern mortgage industry works.

It is not just home ownership; any asset can be leveraged this way. Ownership is central to generating wealth in this country. Still don't think so? Can you name at least one millionaire or otherwise wealthy person who didn't get there through the ownership or use of a business? Go on ahead and use Google if you want. I'll wait.

Ownership is central to my plans because if I can pay you an additional $88k for a thing, does it not stand to reason that I could pay that to myself? How am I not better off with that money in my pocket?

you are never really safe. First, without a loan of any kind you are subject to the whims of bureaucrats at all levels of government in the form of taxes, zoning, right of ways, and permitting.

You aren't ever safe. All things are lethal given a long enough timescale. If I cannot have 1, then .99 is a lot better to have then .78. Also, you will face these hurdles with or without a mortgage. If they are only monetary hurdles - and most of those are - then I am better equipped to handle them with that $88k per $100k of interest in my pocket than in someone else's.

Second, houses cost a significant amount per 5 years to keep and are on an accelerating cost curve. The curve becomes more extreme if you must meet certain requirements placed on you by the city or HOA.

These are hurdles you will face in procuring a house, mortgage or not. Maintenance must not be as significant a cost to deal with as a mortgage. How do I know? Because if upkeep for a house totaled to some significant fraction of it's total cost, home ownership would be untenable for millions of people in this country, and home renting would not be tenable as a business, as all the revenue would eventually and permanently go to upkeep of the property. Our real estate market would somewhat resemble Japan's, a place where property taxes almost approach the price of the home itself.

Loans are not a bad thing. If you do not ever process through a lending system you will not have credit to do and leveraging. Without leveraging you will never be able to flex outside your direct wealth pool.

So I'll never be able to get into debt and never be leveraged? That sounds great.

Just because you own a house doesn't mean you won't have some major problem where the HVAC, water heater, oven, and fridge all go out at the same time due to bad luck... the same week your car blows it's engine.

Are you better equipped to deal with financial disaster with more access to money, or less? No matter how you want to frame the argument, it will remain true that signing up for more leverage reduces your ability to save for events exactly like this one. A person with considerable savings in the middle of these events will be better equipped to deal with them than a person who has already agreed to considerable outlays. They just will.

Loans aren't bad. Stupid people are bad. Credit lines are like rope. Give it to people who know how to use it, and they can climb Everest. Give it to stupid people and they will hang themselves with it.

Your rope is nice. Glad you enjoy using it. But, I have my hands, feet, trusty pick axe, and a map. This isn't even the first time I've climbed a mountain. What do I need a rope for?

Casper

> PS9

Casper

> PS9

01/21/2014 at 13:34 |

|

What? If you could leverage a lease on every vehicle in the US you could say the same thing. There are massive differences between owning a home and a business. You are grasping at straws on that one. I am a business owner as well as a home owner, and I can not see what you are trying to draw between the two. A business generates income and wealth, a house does not. A house is just a place to live that has the potential to function as an investment asset. It has no better return rate or guarantee than direct market investments. My businesses explicit function in the world is to generate revenue, provide me income, and create wealth through the conversion of labor and materials. There are also no similarities between the two for sales either.

Just because I challenge your assumption of ownership does not automatically mean that the only logical alternate option is a mortgage. Your example takes an APR (ignoring most 30 year mortgages are fixed rate), and extrapolates interest. It ignores the cost of ownership or leverage of wealth provided by access to the load. For instance, if you are working at a job making $2500 a month net and are saving for a house, it will take you 22 years to save enough for a house (roughly) that you would have paid off with a 30 year mortgage. During that 22 years, you are still paying for rent/utilities while saving. Now, if doing so worked for the entire duration of saving the value of the house, why not continue to do so forever? It does not incur nearly the same level of liability nor does it incur the yearly maintenance expense. The only way it falls behind is under the logic that once the lump some payment is made the average cost is lower on the house, which can be true, but the key word is CAN. It can also be much more expensive if you suffer a massive expense.

Again with the rest of your post, you are for some reason under the impression that I am arguing in favor of a mortgage, which I am not. So I'm just going to ignore it.

PS9

> Casper

PS9

> Casper

01/21/2014 at 14:12 |

|

A business generates income and wealth, a house does not.

This statement is simply not true. How is there a multi-trillion dollar global mortgage industry if houses cannot be used as instruments to leverage wealth out of the economy?

For instance, if you are working at a job making $2500 a month net and are saving for a house, it will take you 22 years to save enough for a house (roughly) that you would have paid off with a 30 year mortgage.

For a $100k house, this represents only $4k/year of savings. Out of a post-tax revenue of $30k, this person can only save 13%/year of what they make.

I'm not about to ridicule anyone for that here. A lot of times, circumstances beyond your control force your hand. A person who has a family would like them to have a good life now while they can provide it to them. But - and there is simply no question about this - such a low revenue-savings ratio for such a person is dangerous. It leaves them completely exposed. If even one of the appliances you mentioned before in their home went out, it would take 3 months of saving just to get it back online.

The average time spent unemployed in this country is 10 months. That's almost a year. Never mind saving to buy a house; is this person even equipped to deal with such an unfortunately likely and common emergency, considering such a tiny savings ability?

I would be more comfortable with an average of 50% (which is where I'm at IRL). This would be closer to $15k/year saved, and would make saving for a $100k home Doable in 6 and a half years, not 22 (and beats even my own estimates by nearly 4 years). Not everyone is in a position to do that, I realize. But I'm not looking to do what works for everyone; I'm only looking to do what works for me.

Now, if doing so worked for the entire duration of saving the value of the house, why not continue to do so forever? It does not incur nearly the same level of liability nor does it incur the yearly maintenance expense.

What if I told you that, with just a few years of hard work and planning, you could be in a position to save most (For me, it would jump to 80%) of the money you make? That you would have the opportunity to significantly insulate your self from some of the worst economic calamities? How would you like to take a vacation after being laid off from a job, instead of scrambling to find another one? How would you like to have the opportunity to retrain and re-educate yourself if your industry is shipped to somewhere else where they do what you do for cheaper?

For that, and some other reasons, property ownership matters to me, and I want to be a part of it. I don't want you to feel like you're wasting your time, but nothing you or anyone else tells me is going to convince me that owning my own house, my own car, with 0% debt and no leverage is somehow bad. It's not happening.

Ownership is the cornerstone of our economy. For those who have it, it is the ultimate flexibility. I bet it feels good to you, knowing no one can fire you from your own business and repossess the house you own yourself, doesn't it? I don't get how you can on one hand, find personal success through ownership of considerable assets, and on the other hand, come here and try to explain to me what's wrong with those same ideas.

Casper

> PS9

Casper

> PS9

01/21/2014 at 14:29 |

|

You can't separate the generation of wealth by a business based around a commodity such as property vs the actual business it's self, which makes talking to you impossible. It's like you took 10 too many 5 Hour Energy's and decided to jump on the internet. My business is in software development and hosting, it has nothing to do with real estate. Business and owning a home are nothing a like. Even if my business was in real estate, it wouldn't be relevant. The home you own is not inventory for the development of wealth for the business. They are separate assets.

No one tried to tell you any of the things you are assuming. You are the one making ignorant assumptions based on simplistic views and limited understanding of the larger picture. You are attempting to state absolutes as if fact simply because you are choosing to apply them to yourself. We simply pointed out you are making illogical statements to justify your opinion.

JoelA237

> PS9

JoelA237

> PS9

01/24/2014 at 02:30 |

|

I'm with you on this one.. I hate debt. I am just now getting out of a mess I created for my self over it. Once its all gone, I am NOT getting back into debt. It's stressful always having that payment hanging over your head. Owning something outright is the best IMO.